Maximizing Financial Performance: The Economic Advantage of the Hybrid ED & Urgent Care Model

A Solution to ER Overuse and a Driver of Financial Growth

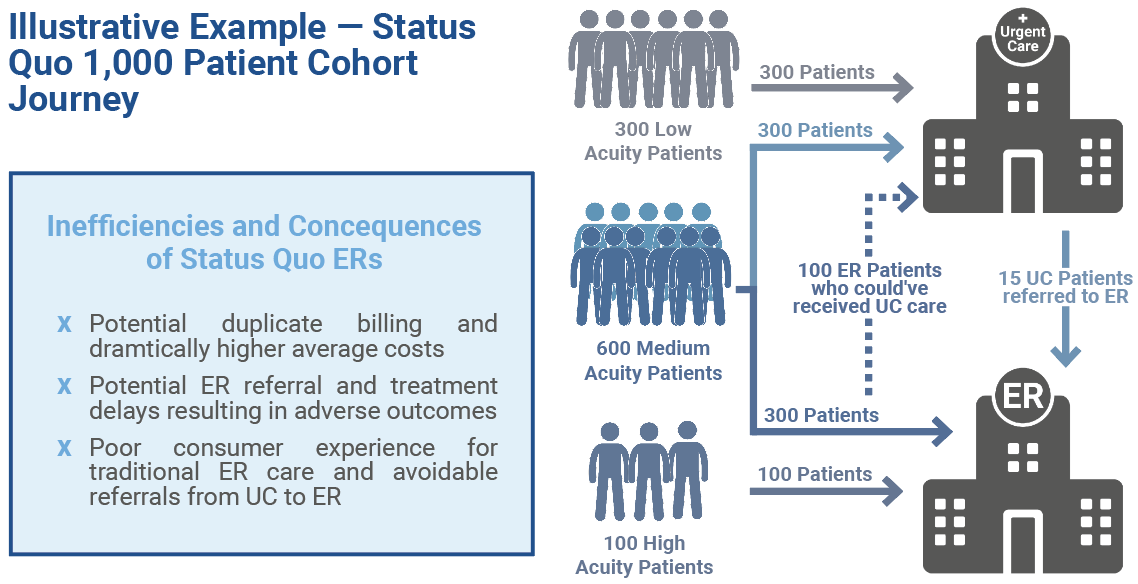

Emergency services overuse has become a leading operational and financial drain on health systems, resulting in crowded facilities, high rates of patient dissatisfaction and millions in unnecessary expenditures. Despite the proliferation of standalone urgent care and emergency centers, patient confusion persists and the majority of ED visits, according to multiple analyses including those by the National Bureau of Economic Research1 and UnitedHealth Group2, remain potentially avoidable or treatable in a lower acuity setting.

Key Drivers of This Inefficiency Include:

- Patient uncertainty about where to seek care.

- Fragmented access points and misaligned incentives.

- Lack of real-time guidance or triage at the door.

The cumulative result is long wait times, rising operational costs, elevated risk of patient leakage and intense strain on system profitability.

Limitations of Traditional Care Models

1. Financial Inefficiencies

Traditional emergency and urgent care models are inherently misaligned with the financial and strategic imperatives of today’s health systems. CFOs face undue pressure as non-emergent visits are funneled into EDs by default, with the mean hospital all-in cost for a treat-and-release ED visit reaching $1,7123compared to just $1474in urgent care — a more than tenfold cost differential. These systemic inefficiencies lead to millions in avoidable annual spending, eroding margins and directly impacting a system’s bottom line. The lack of a streamlined pathway for lower-acuity cases not only inflates operational expenses but also creates significant billing and reimbursement complexity, making it difficult to accurately project and manage revenue cycles.

Beyond the immediate waste, this environment creates unpredictable utilization patterns, driving up staffing costs and facility overhead. CFOs are left to contend with shifting financial targets, an unfavorable payer mix and an inability to capture downstream revenue otherwise lost when patients exit the network.

2. Access Bottlenecks

The current fragmentation between urgent care and emergency settings results in widespread access challenges. Standalone urgent care clinics, though well-positioned for low-acuity cases, frequently lack the diagnostic capability, imaging, or clinical expertise to manage even moderate-acuity patients. As a result, the Urgent Care Association’s benchmarking shows 5% of patients are referred or redirected to the ED—delaying care, incurring duplicate bills for both sites, and frustrating both provider and patient.

Meanwhile, emergency departments become congested with non-urgent visits, reducing throughput for high-acuity patients and exacerbating length-of-stay metrics. This cascade effect leads to bed shortages, lost ambulance runs, and suboptimal throughput impacting patient experience and system capacity. The financial repercussions for the health system are measurable:

- Higher labor costs due to bottlenecks

- Reduced charge capture from legitimate emergent cases

- Diminished ability to grow or optimize site-level profitability

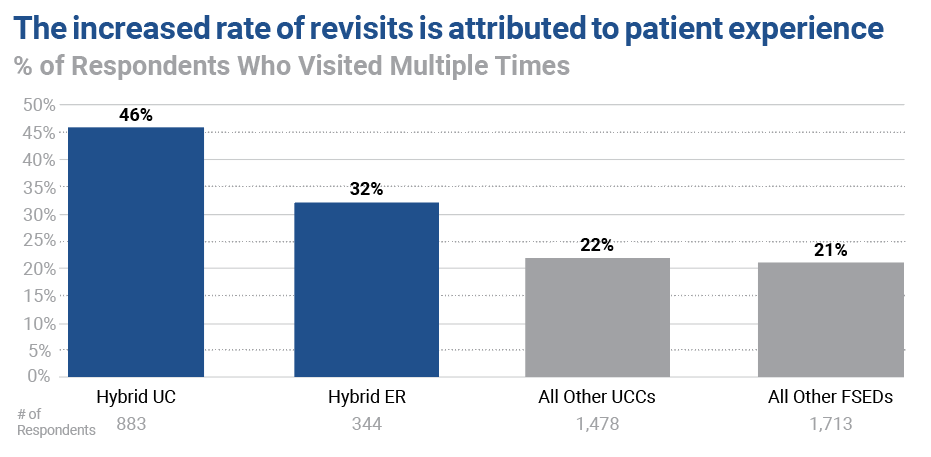

3. Erosion of Patient Loyalty

From the CFO’s perspective, every misdirected encounter is a leakage threat to the organization’s future revenue potential. Patient frustration multiplies when individuals are shuffled between disconnected care sites or face unclear explanations for their bills. Without integration, the likelihood of lost follow-up appointments, lower revisit rates and poor patient experience scores increases substantially. In the hyper-competitive healthcare landscape, high lifetime patient value is directly correlated with loyalty and system retention, which are two strong indicators that the traditional model consistently underperforms. It should come as no surprise that Press Ganey and other patient experience organizations have reported unprecedented decreases in patient experience scores in emergency departments.5

Brand equity also takes a hit. Unresolved patient complaints and unnecessary financial exposure erode trust, negatively impacting referrals, market share, and contract negotiations with both payers and employer groups. Traditional care settings often overlook these softer, but profoundly important, drivers of long-term financial strength.

The Hybrid ED & Urgent Care Model

A Data-Driven Solution

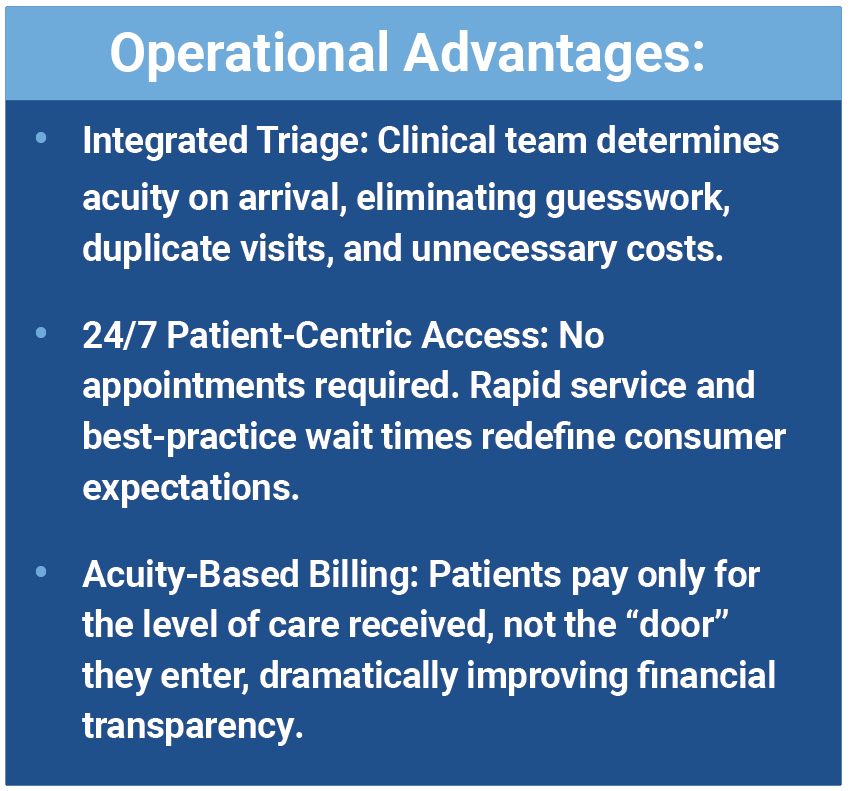

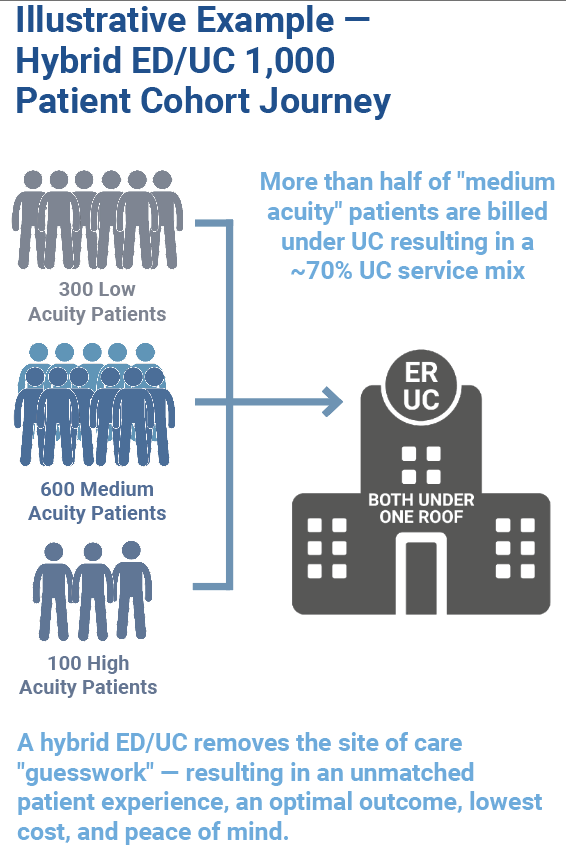

The hybrid ED/UC model, pioneered and scaled by Intuitive Health, fills the access gap by integrating real-time triage, emergency and urgent care in one location. Every patient is evaluated at the point of entry by clinical staff and routed to the proper level of care, ensuring optimal transparency and efficiency.

Financial and Strategic Benefits

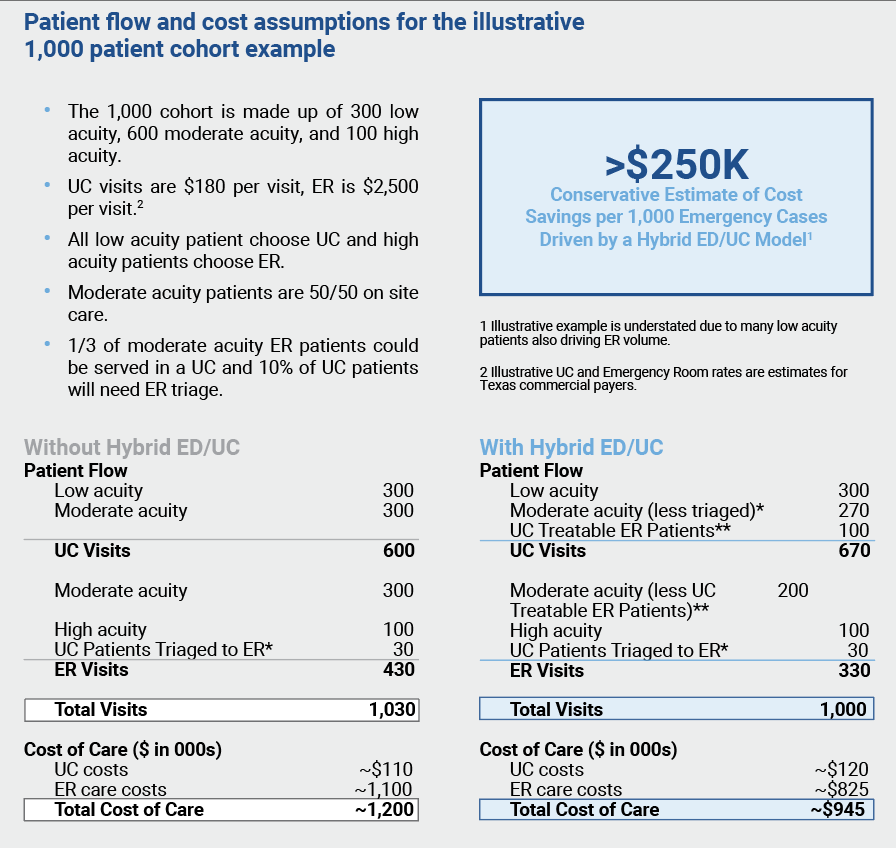

1. Significant Cost Savings

- Redirecting eligible cases from ED to urgent care delivers up to $200 saved per hybrid care model visit for payers.

- Commercial health plans see an average $780 saved per ED episode.

- A conservative estimate for total cost savings driven by the hybrid care model per 1,000 emergency cases is more than $250,000.

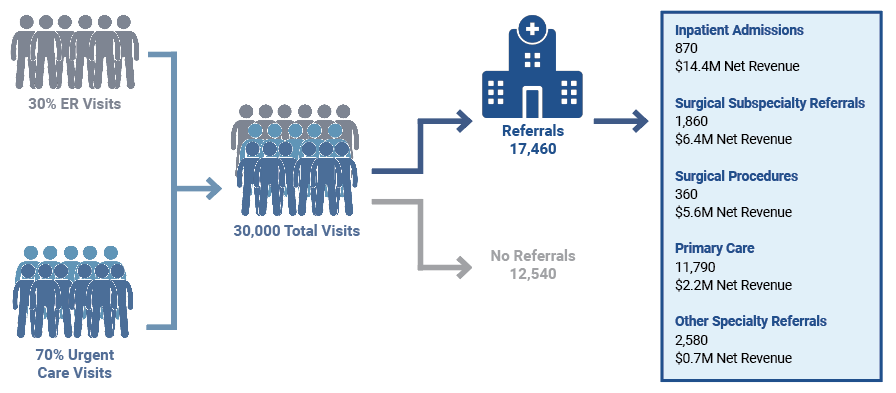

2. Substantial Downstream Revenue

Each hybrid site generates over

$29.3 million in annual downstream net revenue ($803,000 per 1,000 visits) driven by:

- Higher rates of primary and specialty care referrals

- Increased admissions generated from new patient visits

- Enhanced network capture and lower patient leakage

3. Market Share Expansion and Patient Retention

- Net Promoter Scores (NPS) at hybrid centers consistently outpace traditional settings, exceeding 75.

- Online reputation scores (Google star ratings) at hybrid centers are consistently higher than similarly located urgent care centers and local hospital based EDs, exceeding 4.5 out of 5 stars.

- The model is adaptable across diverse markets (urban, suburban, rural), supporting both growth strategies and network protection.

4. Accelerated, Predictable ROI

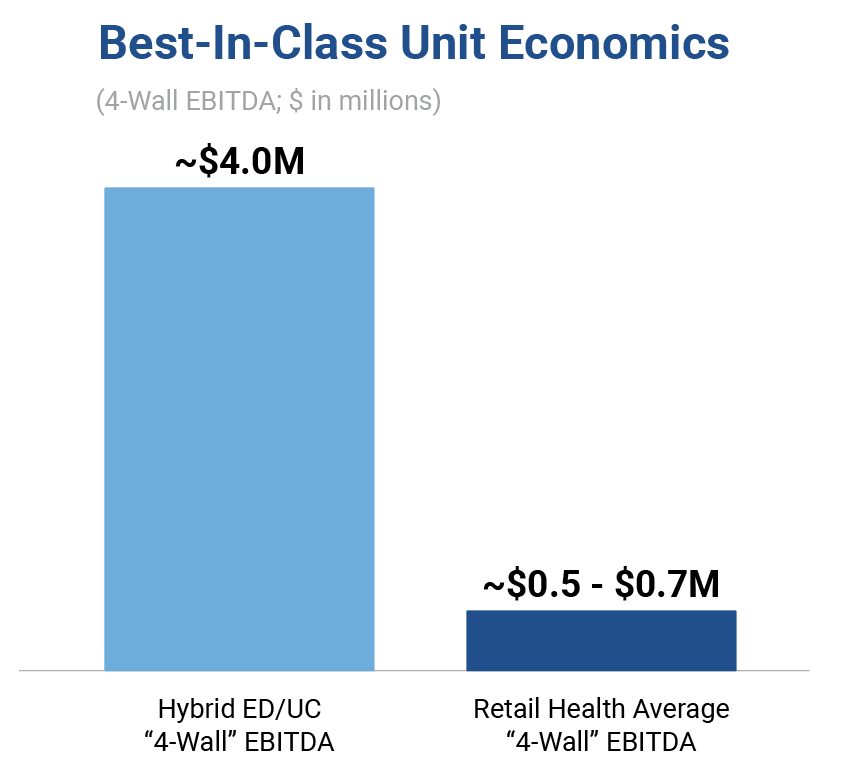

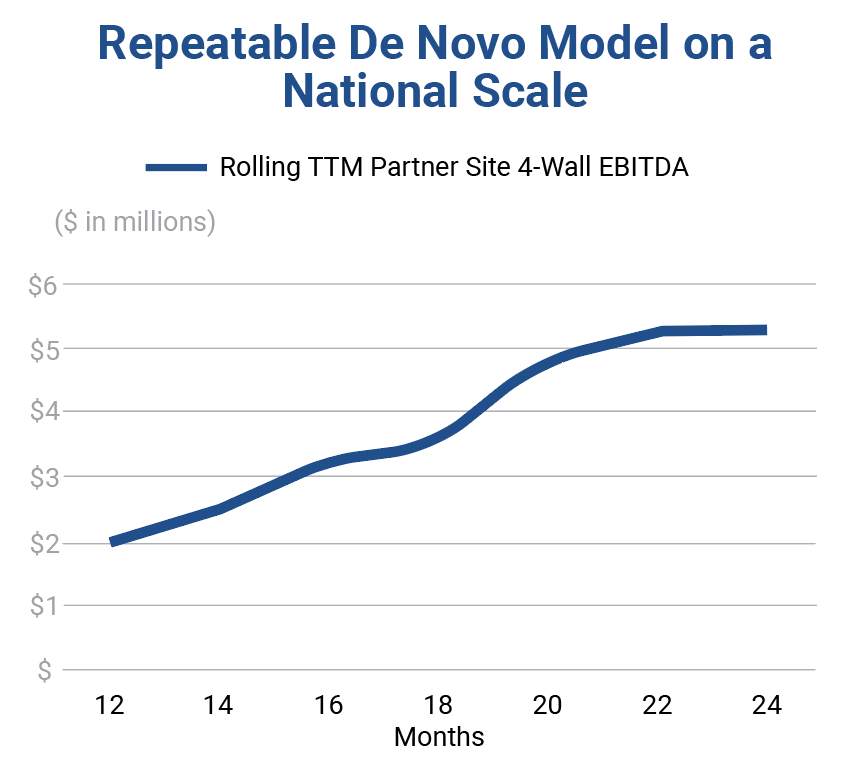

Mature hybrid sites routinely reach break even within 18–24 months and sustain annual EBITDA per site of $4 million or more. The hybrid ED/UC model site-level unit economics far exceeds other healthcare services investment opportunities with an approximate 6x higher “4-Wall” EBITDA than average retail health platforms. The hybrid model is also uniquely capable of addressing high-acuity patients efficiently, resulting in significant profitability without the reliance on specialized physicians.

Scalable Partnership, Proven Platform

With 15+ years of operational experience, Intuitive Health leverages its leading unit economic model through a repeatable de novo playbook across both owned and partner sites, achieving $2M+ of profitability in Year 1. Intuitive Health has unlocked significant whitespace nationally and de-risked new market entry through its joint-venture partner model that provides end-to-end capabilities, including:

- Proprietary real estate and demand analytics for optimal site selection

- Turnkey site development, marketing and clinical operations

- Flexible joint venture or MSA structures aligned with health system partners’ financial objectives

- A record of zero closures and sustained NPS leadership

Maximize Your Financial Impact with a Hybrid Strategy

The hybrid ED & Urgent Care model offers health systems a proven mechanism for capturing lost value, enhancing the patient experience and restoring margin resilience. The superior value proposition to the patient results in site level profitability, increased ambulatory market share, and unlocks more than $29 million in annual downstream revenue per facility. With a path to break even in as little as 18 months and mature sites delivering $4M+ EBITDA annually, this model provides scalable, predictable bottom-line results.

About Intuitive Health

Founded in 2008, Intuitive Health pioneered the combined emergency department and urgent care model, setting a new standard for innovation and accessibility in the ambulatory care space. Partnering with leading health systems nationwide, Intuitive Health builds and operates retail healthcare facilities that seamlessly integrate urgent care and emergency services under one roof. This innovative model enhances patient experience, reduces unnecessary emergency care costs, and empowers health systems to expand their market presence. Ranked among the top 1% of global retailers in customer satisfaction, Intuitive Health serves more than 1 million patients annually. For more information, visit IHERUC.com.

1 https://www.nber.org/papers/w25428

2 https://www.unitedhealthgroup.com/content/dam/UHG/PDF/2019/UHG-Avoidable-ED-Visits.pdf

3 https://hcup-us.ahrq.gov/reports/statbriefs/sb311-ED-visit-costs-2021.pdf

4 https://s3.amazonaws.com/media2.fairhealth.org/whitepaper/asset/FH%20Healthcare%20Indicators%20and%20FH%20Medical%20Price%20Index%202024%20-%20A%20FAIR%20Health%20White%20Paper.pdf

5 https://info.pressganey.com/press-ganey-blog-healthcare-experience-insights/us-emergency-departments-seeing-unprecedented-decreases-in-patient-experience